Starting in 2025, France applies an annual tax mechanism designed to guide corporate vehicle fleets toward progressive electrification.

Rather than constituting a uniform tax applicable to all companies, this mechanism operates only under clearly defined conditions and is triggered in specific situations. Understanding it does not require memorizing individual figures, but rather identifying which companies fall within its scope and how the system functions in practice.

(Image Source: GreenSpot)

Which companies fall within the scope of this tax?

Whether a company is subject to this mechanism first depends on a clearly defined fleet size threshold.

Only companies whose fleet of light vehicles reaches or exceeds an annual average of 100 vehicles may fall within the scope of this tax.

The “100-vehicle” threshold refers to the average annual size of the fleet, not the number of vehicles held at a specific point in time. Companies whose fleets remain below this threshold are therefore excluded from the scope of the mechanism.

From a regulatory perspective, this means the tax is primarily aimed at medium-to-large corporate fleets, rather than all companies operating vehicles.

Under what circumstances is the tax actually due?

Reaching the fleet size threshold does not automatically result in taxation.

Whether the tax is triggered depends on a single core criterion:

Does the share of low-emission vehicles within the fleet meet the regulatory target set for the year in question?

1)If the target is met or exceeded, no tax is due

2)If the target is not met, the tax calculation is triggered

The mechanism is therefore not a fixed levy, but a dynamic system directly linked to the pace of fleet electrification.

(Image Source: ChargeGuru)

What is considered a “corporate fleet”?

Within this framework, the notion of a fleet is not based solely on vehicle ownership, but on allocation and economic use.

In practice, this includes:

1)vehicles owned by the company;

2)vehicles operated under long-term leasing arrangements (LLD, LOA, etc.);

3)vehicles placed under the company’s control and allocated to business activities or employee use.

Fleet size is not determined by a simple count. Instead, it is calculated using an annual equivalent approach, whereby each vehicle is weighted according to the number of days it is used during the year, resulting in an average annual fleet size.

Which vehicles affect whether the tax applies?

The annual tax applies exclusively to light vehicles within the corporate fleet, including:

1)passenger vehicles;

2)light commercial vehicles;

3)certain light motorized quadricycles (categories L6e / L7e).

Within this fleet:

1)low-emission vehicles (such as battery-electric or hydrogen vehicles)

→ contribute positively to the fleet’s electrification rate;

2)non-low-emission or thermal vehicles

→ contribute to the gap relative to the target and may trigger taxation.

(Image Source: Daily Parking)

What are the annual electrification targets?

To support a gradual and anticipatory transition, the regulatory framework establishes a progressively increasing annual target for the share of low-emission vehicles in corporate fleets.

These targets follow a clearly defined trajectory, rising from 15% in 2025 to 48% in 2030.

Compliance is assessed year by year, based on the company’s actual position along this trajectory.

How do these rules operate together in practice?

The parameters described above—fleet size threshold, annual targets, definition of low-emission vehicles, and fleet renewal decisions—do not operate independently.

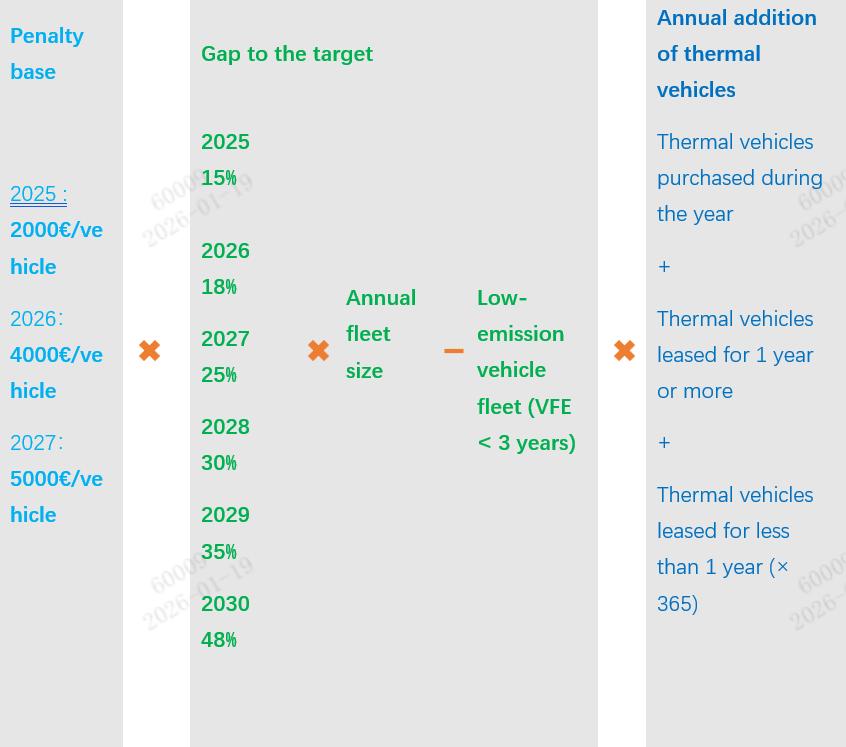

In practice, they are integrated into a single calculation logic, as summarized in the diagram above.

Starting point: the annual reference tariff

The calculation begins with an annual reference tariff, which varies by year:

2025: €2,000

2026: €4,000

2027 and beyond: €5,000

This amount does not represent the final tax payable, but rather the unit cost applied to the electrification gap.

Core variable: the gap relative to the annual target

The calculation then returns to a key question:

For a given year, based on the regulatory target and the size of the fleet, how many low-emission vehicles should the company theoretically have, and how many does it actually have in operation?

The target percentage, annual fleet size, and number of eligible low-emission vehicles are combined to produce a quantifiable gap.

How fleet renewal decisions influence the final amount

The tax does not depend solely on the size of this gap.

As illustrated on the right side of the diagram, a further assessment is made:

In a situation where targets are not met, has the company continued to introduce or renew thermal vehicles during the year?

The calculation therefore takes into account:

1)thermal vehicles purchased during the year;

2)thermal vehicles leased for one year or more;

3)thermal vehicles leased for less than one year, adjusted on a pro-rata basis (e.g. 90/365 for a three-month lease).

These elements adjust the final amount to reflect the actual direction of the company’s fleet renewal decisions.

An overall perspective on the mechanism

Taken as a whole, the annual green tax is not a static penalty, but a dynamic regulatory tool that simultaneously evaluates:

1)fleet size,

2)the gap relative to annual targets,

3)and the concrete decisions made by the company.

What the mechanism ultimately seeks to assess is not simply “has the company purchased electric vehicles?”,

but rather: Is the company effectively adjusting the structure of its fleet in the expected direction, along a clearly defined timeline?

Within this regulatory framework, corporate fleet electrification is no longer solely a matter of vehicle procurement. It becomes a long-term transformation process that must be planned, structured, and actively managed.

If your organization is currently assessing or advancing its electrification strategy, we share our approach through a dedicated AC charging solution designed specifically for corporate fleets. Our solution is available for download via the link below:

https://www.injetenergy.com/uploads/Injet-Swift-2.0-AC-Charging-Solution-for-Corporate-Fleets.pdf